Laboremus partners with ADC, Rabobank to develop dairy industry

ADC, Rabobank Foundation and Laboremus Uganda are happy to announce a partnership to help Uganda’s dairy farmers and cooperatives grow. The three parties are signing an agreement today to bring Emata to even more dairy farmers and cooperatives in Uganda.

As part of the agreement, Rabobank Foundation will support the continuous development of the Emata solution. Moreover, ADC-supported cooperatives will get access, training and support for the Emata solution.

Emata makes managing a cooperative easy. The solution unravels administrative clutter, increases transparency and turns risky bulk cash transactions into safe one-click digital payments. On top of this, Emata provides greatly needed insight into daily operations. This helps farmers and cooperatives make better and more informed decisions.

Through Emata, ADC cooperatives will gather information about the productivity of their farmers, as well as understand which farmers are performing well and which require more training. Emata also facilitates communication between the cooperative and the farmers, and settle payments based on daily prices. As Emata can be operated offline, it even works in areas with fluctuating data connectivity.

“Laboremus is excited to partner with the Rabobank Foundation and ADC, two organizations that share our vision for the potential and future of the agricultural sector in Africa. Through smart use of both technology and field training, we believe that this partnership will build a foundation on which cooperatives and farmers can grow stronger, more efficient and prosperous,” says Bram van den Bosch, Managing Director of Laboremus.

See highlights from the press conference here, courtesy of UBC Business Roundup:

SOURCE: LABOREMUS

Minister Sempijja urges farmers on mechanization

The Agriculture minister, Vincent Sempijja has asked farmers to embrace agriculture mechanization practices to simplify farming and achieve higher yields.

“Many people have large chunks of land but none of them has a bull dozer to ease farming,” said Sempijja, adding that the Government shall soon introduce regional mechanization centres, aimed at transforming agriculture.

“Most of our products are on demand in various markets worldwide.

For example, the Arab market, wants our fruits and cereals.

“Russia, China and the United States, are the other countries with high demand for our products. However, it is sad that we can not produce the quantity they need,” he said.

This was during the flagging off ceremony for 10 winners in the 2017 best farmer competition, organised by Vision Group and sponsored by the Embassy of Netherlands in Uganda, dfcu Bank and KLM Airlines. The event took place at dfcu offices in Nakasero on Thursday evening. The farmers are set to travel on Saturday. The Vision Group Chief Executive Officer, Robert Kabushenga appealed to banks to put in place special loan services for farmers. For instance, mechanisms on quick access to loans, favorable payment periods, among others.

“You may end up making more money if you reduce interest rates on loans for farmers,” he said, adding that most of them need quick loans.

He said one of the things he intends to learn from Netherlands is farm management systems. Henk Jan Bakker, the Dutch Ambassador to Uganda explained that the private sector players in Uganda can only thrive once Government creates an enabling environment for them to operate in. He appealed to farmers travelling to Netherlands to act as mindset change agents in their communities especially to those taking part in agriculture. Jimmy Mugerwa, the dfcu bank’s board chairman applauded Vision Group and partners for their contribution towards agriculture transformation, through organising such farmer competition.

“We as dfcu bank pledge to support and continue supporting these competitions,” he said.

Netherlands farmers’ tour a good move

Anja de Feijter, the chairperson Netherlands-Uganda Trade and Investment Platform (NUTIP) noted that such farmers will learn a lot on mechanization, efficiency and agribusiness management ideas from Netherlands.

Feijter, who is also the executive director Agribusiness Development Centre (ADC) said Uganda has a lot of opportunities in agriculture with its favorable climate and fertile soils but the sector (agriculture) has been contributing less to the economy.

She attributed the issue to use of traditional farming methods, low financial literacy skills and lack of information on available markets for their products.

He noted that once farmers get access to quality inputs coupled with modern farming practices, the contribution of agriculture towards GDP can increase from the current 25%.

“Currently over 70% of Uganda’s population is involved in agriculture but the sector contributes only 25% to GDP. The sector capable of contributing even 50% if farmers get enough access to knowledge in agriculture and quality inputs, ”she stated.

How a new emata app is boosting dairy production

A new mobile app is bringing financial products to farmers across East Africa. Emata is tailored for dairy farmers and will allow them to use the power of loans to invest in the productivity of their farms.

Through transparent recording, the app will also ensure daily milk deliveries are registered whereby the farmer automatically gets instant information about the quantity and price of the milk delivery, writes BAKER BATTE LULE from The Observer.

According to statistics from Uganda Dairy Development Authority, out of Uganda’s annual milk production of 2.5 billion litres, 80 per cent is sold while 20 per cent is consumed by the producing households.

But much as the biggest percentage is sold, farmers barely get what is due of their efforts. Oftentimes, middlemen take the lion’s share of proceeds from milk and this is so because farmers face challenges such as difficulty in accessing the market, production on a small scale by individual farmers and failure to access financial services to improve on production, among others.

It is for such bottlenecks that Laboremus, a financial and technology company based in Kampala with roots in Norway, teamed up with the Agriculture Development Centre [ADC] and the Rabobank Foundation to find solution.

The result of this partnership is Emata, an online app that helps farmers access credit, know about the prices of milk as well as access animal drugs and feeds, among others. According to Bram Willen van den Bosch, the managing director of Laboremus, Emata technology will go a long way in uplifting the standards of living of rural farmers.

Because of this, Agribusiness Development Centre (ADC)-supported cooperatives can now get access, training and support for the Emata solution. Through the app that can also work without internet access, Emata is building a credit history through digitising milk delivery systems. Using this information, Laboremus then extends credit to farmers, having assessed the productivity of their farms.

Loans are processed and given out using the phone without one having to first go to a credit facility. Recently, Laboremus, ADC and Rabobank Foundation signed a memorandum of understanding to work together to see the success of the app.

In the memorandum, Rabobank Foundation, which holds majority shares in Dfcu bank Uganda is to provide finance to Laboremus to carry out a pilot study of the app starting with the Bugerere Dairy Cooperative Society.

On the other hand, ADC which already works with the cooperative society that was started in 1968 and boasts of 330 members to provide training on how to manage a cooperative and also financial literacy, will continue to educate dairy farmers on how they can leverage working with the app.

Speaking at the signing of the memorandum of understanding in Kampala recently, Bosch said farmers are yet to benefit fully from dairy farming because of lack of information. He said using cooperatives to reach out to individual farmers has been a successful mode elsewhere in the world; that’s why they want to try it out in Uganda.

“The potential for agriculture in this country is very high but we believe that technology is the future for farmers. We want to improve the way cooperatives are managed in all forms, including financial management,” Bosch said. He added that Laboremus is happy to work with Rabobank Foundation, the biggest agricultural bank in the world, and ADC, to improve agriculture not only in Uganda but the whole of Africa but using Uganda as a model”

“Through smart use of both technology and field training, we believe that this partnership will build a foundation on which cooperatives and farmers can grow stronger, more efficient and prosperous.”

Emata was launched in 2017 with a vision to provide affordable loans to farmers across East Africa. Commercial banks rarely give loans to especially small-scale farmers for the risks associated with the agricultural sector such as bad harvests, price fluctuations and drastic changes in weather, among others.

For her part, Anja de Feijter, the managing director of ADC, said they will continue to provide financial literacy to farmer groups so as to increase household incomes.

“The diary sector is very important to Uganda’s economy; that’s why we realised the need for training and financing especially using technology to develop individual farmers to improve their livelihood,” de Feijter said, adding that by 2022, they will have trained 180,000 farmers.”

Pim Mol, the managing director of Rabobank Foundation, said they have interest in growing agriculture in Uganda so as to use it as a success model elsewhere in Africa.

“There is a very good possibility to develop innovative ways to change livelihoods for farmers. Access to finance across the country, we believe, will significantly improve the agricultural sector in Uganda like it has done elsewhere in Europe where we have worked,” Mol said

He added that the dairy sector is data-driven; therefore, there is need to provide farmers with relevant information on how to improve production and also get better prices for their products.

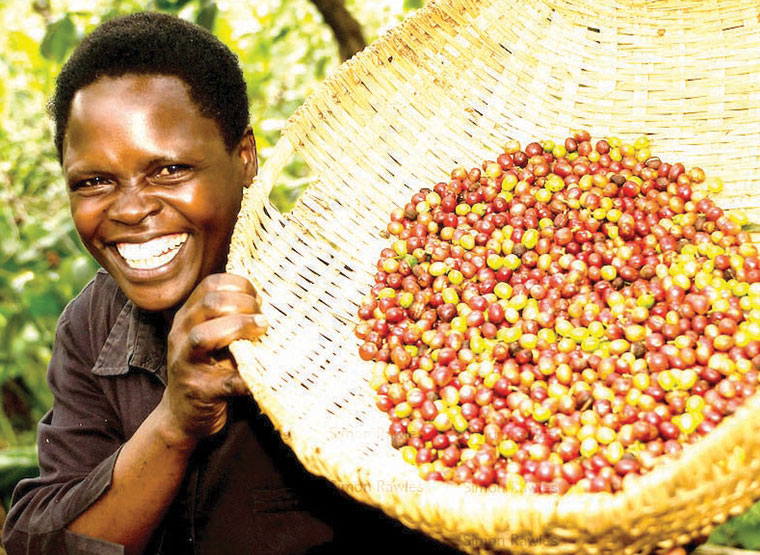

More effort needed for Uganda to meet coffee export target

For Uganda to achieve its 2025 vision of exporting 20 million bags of coffee, there must be concerted efforts of all stakeholders. This was the message of Anja de Fijter, the executive director of the Agribusiness Development Centre (ADC) at a two-day training of farmer based organisation leaders in Kampala. The leaders of 64 farmer groups were in Kampala to be coached on how to manage market risks by knowing about the prices of coffee on both the national and international market before selling.

“We see that farmer-based organisations still need a lot of support in this area, they need to learn what influences the price of coffee. It is not only Uganda that influences prices at the international market but the different producing countries,” de Fijter said.

“Uganda wants to export 20 million bags of coffee in 2025 and everybody who has interest in coffee should work in a united way to promote the sector because it’s a very important sector.”

It is estimated that Uganda has over 1.7 million coffee farmers looking after about 900 million coffee trees. This makes it the biggest coffee planting country in East Africa.

“If we can get our sector organised, get farmers access to finance, then we can know that we can meet the 20 million bags we are targeting,” de Fijter said.

Kizito Mayanja an official working with the Coffee Development Authority (UCD) was put to task by the participants to explain what government was doing to ensure that its 20 million bags target was achieved.

“Was this a political target aimed at exciting some people or indeed you are serious about it? What are you doing as government to ensure that it’s attained?” Andrew Mulwanyi, a farmer from Masaka asked.

Mayanja explained that as UCD they have moved in several parts of the country explaining to people about best farming practices. He added that they are also giving out millions of coffee seedlings to farmers across the country.

He was however noncommittal on whether the target of 20 million bags is attainable in 2025. Uganda currently exports 4.5 million bags of coffee per year. The training, part of the many so far organised by ADC, this time also targeted cocoa farmers because it is also increasingly becoming one of Uganda’s leading export earner. In 1990, Uganda did not export even a single tonne of cocoa but last year 24,000 metric tonnes of cocoa were exported fetching $48 million.

“It is really becoming a very serious export product for Uganda. That’s why we think that the farmers should be informed about the prices and protect themselves against market risks,” de Fijter said.

SOURCE: THE OBSERVER

Coffee farmers trained to boost exports

At least 45 coffee farmers from across the country have received training on how to market and export their products. The Agribusiness Development Center (ADC) with support from the Rabobank Foundation and DFCU bank targeted mainly farmers who are also leaders of cooperatives on how to handle coffee fit for export, how to negotiate a contacts, and skills on how to get information for better prices.

Katia Mugenzi, ADC marketing and information manager said coffee farming has got very many risks but the biggest of all is pricing. Therefore, she said, there is need to train them in order to reduce the risk that majorly emanates from lack of information.

“The training was about price risk management, because many a time our farmers are cheated by middlemen; it is them who have information about the market. This is because most of the time coffee prices are determined elsewhere,” Mugenzi said.

She said their emphasis is on coffee exportation because there are other organizations that are already focused on production.

“It doesn’t make sense if farmers produce their coffee and they are unable to benefit from its sale. Therefore as ADC we are helping farmers especially those working under a cooperative to get pre-finances that is vital in exportation,” Mugenzi said.

She added that she was also very excited that young people are beginning to take agriculture seriously.

“It is very encouraging that we are now seeing youths getting involved in agriculture. This shows that the sector will register tremendous development,” Mugenzi said.

Anja de Fijter, the head of ADC said there is an increase in coffee exports. She said currently Uganda exports almost five million coffee bags. “There is no doubt people continue to embrace coffee growing; the sector has a bright future,” de Fijter said.

According to some of the trainees, the two day training couldn’t have come at a better time.

“I now know about contracts, all the terms involved in exporting. I don’t think buyers will be able to manipulate me again,” Ronald Odia, a farmer from Zombo said. For Matovu Richard a farmer from Mbale, the training helped him to equip him with knowledge to make better decisions.

“I have learnt how to negotiate for better prices not to take whatever the buyer offers after all it’s my coffee,” Matovu said. For Mary Nalukwata a farmer from Masaka, such training helps them to be competitive.

“We sell in the same markets with people from developed countries who are well conversant with the market dynamics yet for us we don’t even know what the markets want. Therefore this training was really beneficial to us,” Nalukwata said urging ADC to organize such training even at production level.

SOURCE: THE OBSERVER

Anja de Feijter proud of her Ugandan passport; hopes for Ugandan burial

When Anja de Feijter first set foot in Uganda 17 years ago, she had no idea it would turn out to be her permanent home. Anja, the executive director of Agribusiness Development Center (ADC) – an initiative of the Robobank Foundation and dfcu bank – is just one of many foreigners that come to Uganda and never leave. Strange that as millions of Ugandans would give everything to ‘escape’ their country to settle in the Netherlands where Anja was born and raised, there are people in the West whose dream is to hold a Ugandan passport like Anja does.

EXODUS TO AFRICA

When she was told of an opportunity to work in the East African country, she started to do research and the results were not pleasant. The country was recovering from the deadly Ebola virus that had killed hundreds including championing medical workers such as St Mary’s hospital Lacor’s Dr Matthew Lukwiya.

This, on top of the HIV pandemic that was becoming Uganda’s new normal. Her peers thought she was mad to abandon a well-paying job, good house, car and good life to go to a ‘jungle infested with deadly viruses and backward people’, as many in the West still envisage Africa. But it was to Africa and Uganda that Anja headed and found happiness. Born in August 1967 in South Western Netherlands, Anja is the only child of agriculturalists Raines and Jannie de Feijter.

Coming from an agricultural family, Anja says, at a very young age she also developed love for agriculture.

“When I was 12, I told my parents I wanted to be the minister of agriculture. It was a bit strange for a young girl; others my age would want to be hairdressers,” she said in a recent interview. Anja’s father was born just after World War II, which had left a trail of destruction with de Feijter’s farm having no single animal left.

Anja’s father and his siblings could not go back to school. Anja says her father, hurt by not getting full education, worked very hard so his daughter would not suffer the same fate.

“He started his own business selling vegetables using a wheelbarrow; he became a very successful businessman,” Anja says.

Aged 16, Anja left her family home for Amsterdam to pursue education because her home district was not as developed. She went to a horticulture school for four years. Thereafter she moved to the Royal Tropical Institute in the east of Netherlands and pursued a course in international agricultural marketing for four years.

Finally, Anja proceeded to Wageningen University and Research Centre and pursued a degree in agricultural economics, graduating in 1996.

“I took the longest route to study to become an agricultural engineer; I was 28 when I graduated,” she says.

After graduating, she refused to go back to manage the family business, opting to look for a job in the capital. She says she looked for jobs in vain, triggering anger and frustration especially after many years of studying.

A friend told her of an advertisement for an agricultural IT consultant, but she had no idea about IT; nevertheless, she applied. She excelled during the interview as the most eloquent.

“They said they can teach me how to do programming but they were not sure they could teach the other guys how to communicate. I got the job of consultancy despite the fact that I had just left the university,” Anja says.

She worked with the company for four years until one of her clients challenged her on when she was planning to ever use her agriculture education.

ROYAL VAN ZANTEN

There was an opportunity in Uganda as director of an eight-hectare Dutch flower farm, Royal Van Zanten.

“I said, ‘I haven’t been to Uganda but if you can give me a ticket, I can go check it out’,” she says.

When she arrived in September 2000 she was very excited and felt right at home in Uganda.

“I went to Mukono to see how people would react; they were very friendly; everyone was greeting me like I had been part of them. It was a normal thing to see a mzungu on the street. I said to myself, I think I should try the job,” Anja says.

She says that decision was not hard at all, seeing that she had no partner or children to worry about.

Farmers to be trained in negotiating with banks

ANJA DE FEIJTER, the Executive Director of Agribusiness Development Center [ADC], has said Uganda needs to focus more on agriculture if the country is to feed its growing population.

In an interview with The Observer, DE FEIJTER told Baker Batte Lule why there is need to train farmers in different skills.

Briefly, what is ADC all about?

It stands for Agribusiness Development Center and it is an initiative of the Rabobank foundation and dfcu bank. The two signed an MOU in 2015 to start this iniative.

The Rabobank foundation did the same initiative in Tanzania with the NMB foundation six years ago to assist farmers and we thought that it would really be a good initiative for Uganda. The Rabobank invested in dfcu bank and it is a Dutch agriculture corporative bank.

The money which was injected into ADC by dfcu Bank and Rabobank Foundation in the Netherlands is set to benefit farmers for the next five years. Today, it is the second largest bank in the Netherlands. They said they would like to play an important role in the agricultural sector of Uganda.

What type of farmers do you target?

We look at the value chain where investments are needed. We selected value chains that we think are relevant, such as maize, sugarcane, dairy, oilseeds. The farmers we look for must be working in groups and cooperatives. They have to prove that they are part of an active group or cooperative.

They have to show that they have been active for the last three or four years. We don’t want to have farmers that are forced in a group just because they want to have access to finance. We started our first training in Lira a few weeks ago.

Agriculture is one of the most unpredictable sectors affected by changes in weather, making it a risky venture for banks to advance credit. How do you hope to turn this around?

Dfcu bank is now developing new agricultural products, part of which is agricultural insurance.

So, if you get a loan from dfcu bank, then the bank will advise the farmer to get insurance as well so that when there are problems such as drought, then a farmer can get some of his money back.

But insurance is one of those things that Ugandans haven’t embraced fully.

Even in that sector, it will be about training and educating the farmer about what they should be looking at when looking for insurance.

It is the same as talking to the banks; some farmers fear to negotiate interest rates; they think that they are fixed, yet actually, it’s about negotiating a product. The farmers should be able to ask the difficult questions when negotiating for an insurance product.

Are there some selected parts of the country that you are going to focus on?

There are some areas because of the value chain. We also look at the branches of dfcu bank because they give us office space.

So, our business advisors will be in all those areas where dfcu bank has a branch. Now, the bank has more branches; it means we can be in most parts of the country. As for now, we have started in Hoima, Mbale, Lwengo, Masaka and Lira. So, depending on the success and finances, we will spread out to other parts.

What would you identify as the biggest challenge that farmers face?

Lack of access to finance has got a huge impact on the agricultural sector. This has made it very difficult for farmers to get quality products and this has led to farmers having very low-quality produce.

So, if they can get access to enough funding for their products they can also improve on their yields. And once they are able to increase their yields, even if for one season, they can build their capital and in the next season they can start buying better-quality products.

Farmers also complain about markets, saying even when they have got better yields they have nowhere to sell them. Is that something you would address?

If a farmer would know his market well, he would start planning when to start sowing. But at the moment, farmers don’t care about these things. They start thinking about the market when the product is almost ready.

This is one of the things that lead to low market prices. When farmers know there are not enough tomatoes on the market, like in January, February, and March, because it’s a dry season, then they start targeting that period to sell tomatoes.

So, if you teach them how to do production planning and target different seasons, you will see that many farmers will get better prices. And if you have got a cooperative and you have a storage facility, then you can store your produce and sell when the prices are better.

Why did you choose agriculture and not any other business?

The majority of people in this country earn their living from agriculture. Dfcu also has agriculture as one of its strategic sectors. So, that’s why we have a strong focus on it.

At least 80 percent of the country still depends on agriculture. [Uganda also has] one of Africa’s most growing populations. All these people need to be fed.

On November 29, we will introduce ADC to the whole country so that people are aware that we have started our activities. Those interested can apply and also bring on board other stakeholders in the agriculture sector to partner with us.

SOURCE THE OBSERVER

Over 100 farmer groups set to benefit from 10 billion shilling fund

(From left) The managing director of dfcu Bank Juma Kisaame, ADC’s Anja de Feijter, Ambassador Henk Jan Bakker, state minister for co-operatives Frederick Ngobi, Jimmy Mugerwa and chief executive officer of Rabobank Foundation Pierre Van Hedel cutting the cake during the opening of the agribusiness centre at Kampala Serena Hotel on November 29.

Over 100 farmer groups dubbed farmer-based organisations (FBOs) countrywide that have the potential to contribute to the agricultural value chain are to benefit from the sh10.08b fund ($2.8m) obtained by Agribusiness Development Centre (ADC).

This, according to ADC executive director, Anja de Feijter will improve their operations and ultimately become bankable.

She said the organisations will receive the technical support, training on financial literacy and choice of enterprise.

The development was announced during the official launch of ADC at Kampala Serena Hotel.

The money was injected into the organisation by dfcu Bank and Rabobank Foundation in the Netherlands and the fund is set to benefit farmers for the next five years.

Feijter explained that ADC business advisory team is currently pre-visiting over 100 farmer based organisation’s (FBO’s) countrywide and that since October, 70 FBOs have been selected to receive the training skills in governance, financial management, financial literacy, marketing and risk assessment

With these skills, the farmer based operations will continue to grow their operations in ways that are of benefit to both them and the wider communities,” she noted, adding that ADC which started operations in October this year has skilled 44 farmer leaders from 20 FBOs from Lira, Dokolo, Kole, Alebtong and Oyam with skills in governance.

DFCU’s board chairperson Jimmy Mugerwa commended the efforts being taken by the farmer based organisations to acquire finances through forming groups.

Agriculture is the number one breadwinner for our country and there is a need for collective effort to support it. By facilitating ADC in its operations dfcu and Rabobank are building capacity for the farmers to access much needed financial services, he said.

He added: dfcu already provides tailor-made products for the farmers and with the capacity building delivered through ADC the smallholder farmers will be more eligible for financing from commercial banks.

They will also be better placed to increase productivity and possibly embrace commercial farming which is more profitable at household and national level.

The ambassador of the Kingdom of the Netherlands in Uganda Henk Jan Bakker noted that lack of skills is the major deterrent to work with smallholder farmers, hence the need to train and educate them in vocational training.

Allow me to make a reference to the situation in my home country. Educating and training of farmers has been one of the key elements in the successful development of the agricultural sector in Netherlands. Agricultural education and training has developed close farmers in partnership with the private sector, he stated.

200 farmers educated in agribusiness management

LIRA. About 200 farmers from Lira District have benefited from a two-day agribusiness enterprise management training organized by the Agribusiness Development Centre (ADC).

Speaking at the closure of the training, Ms Anja de Feijter, the executive director ADC, said they are optimistic that the training will adequately empower farmers with financial knowledge, business management and marketing skills which lack in farmers in Northern Uganda.

We needed to provide these farmers under farmer organisations and small medium enterprises in the agricultural sector with financial literacy, business management and marketing skills which will positively impact in their different business enterprises,” Ms Anja said.

She added: “Through our partnership with Rabobank Netherlands and dfcu Bank, we have invested in the process that we believe will change the trend of farming and agribusiness in this part of the country (Northern Uganda).

Beneficiary’s view

Ms Margret Acen, a beneficiary, said she discovered that it was possible to store crop produce beyond one season and sell at better prices as well as seek better markets through uniform bargain.

I previously would sell my crop produce immediately we harvest and before I get to the next planting season, there is no money to buy planting seeds but the lesson today has opened my eyes on the significance of good storage, she said.

She said middlemen always cheated them by dictating for them low prices compared to what they were supposed to get as final returns.

Using a team business adviser, ADC plans to select existing farmer groups and train them, carry out regular follow-ups and make sure they are improving and practising the concepts learnt, said Ms de Feijter. About $1m (Shs3.6b) has been sunk into the programme according to her.

In an interview, Mr Godfrey Mundua, the dfcu Bank head of corporate and institutional banking, said they patterned with ADC and singled Lango region because it has many agricultural activities that are important to support.

Through the resource centre, will be able as a bank to directly support these farmers with business loans and train them different financial management skills. We will also link them with bigger buyers just as we took them to Mt Meru Millers, one of our biggest clients, Mr Mundua said.

After concluding the training, ADC also launched its resource centre in Lira, a centre through which the farmers will directly have training and consultations with ADC expertise on agribusiness.

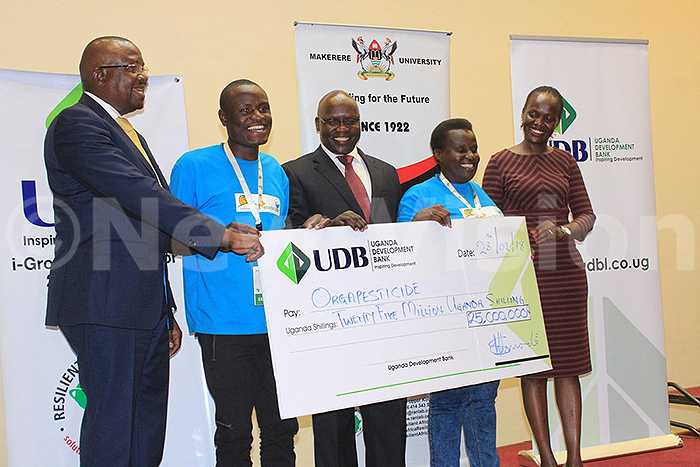

UDB to inject Shs6b to empower innovators

Boosting Innovations

The Agribusiness Development Centre (ADC) executive director, Anja de Feijter, tipped farmers on the use of modern farming methods such as mechanization to increase production quantities.

KAMPALA – The Uganda Development Bank (UDB) is to inject sh6b to empower innovators to enhance their skills, acquire more machines as well as market their innovation products.

This, according to Prof. Samuel Sejjaaka, the UDB board chairman, is aimed at creating more jobs and enhancing economic development.

Sejjaaka, during the I-Growth Accelerator awards for 2017/2018 financial year, said the bank will invest sh5b as equity in viable projects, meaning they will partner with innovators until they break even, while the other Shs1b will be venture capital. The event took at Hotel Africana in Kampala.

Prof. Barnabas Nawangwe, the vice-chancellor of Makerere University, noted that there is need for the Government to offer interest-free loans to innovators so that their products can compete on the globe, saying they were laying strategies at the institution.

We at Makerere University have started new strategic plan to transform Makerere into a research-led university,” he stated.

The Prime Minister Ruhakana Rugunda, who was represented by Gabriel Ajedra, the state minister of finance in charge of general duties, noted that innovations in the agriculture are necessary for economic development of Uganda.

He reiterated the Government’s efforts in boosting innovation through the innovation funds, which are channeled through the Ministry of Science, Technology and Innovation.

The Agribusiness Development Centre (ADC) executive director, Anja de Feijter, tipped farmers on the use of modern farming methods such as merchanisation to increase production quantities.

She said farmer trainings of literacy and entrepreneurship skills are necessary for transformation of agriculture. Last year, ADC got a boost of Shs10.8b for training community-based farmer organisation on train farmers in governance, financial management and risk management, among others.

We have trained 75 farmer organisations and we are going to scale up the number of individual farmers in Hoima, Mbale and Kampala,” she stated.