Farmers to be trained in negotiating with banks

ANJA DE FEIJTER, the Executive Director of Agribusiness Development Center [ADC], has said Uganda needs to focus more on agriculture if the country is to feed its growing population.

In an interview with The Observer, DE FEIJTER told Baker Batte Lule why there is need to train farmers in different skills.

Briefly, what is ADC all about?

It stands for Agribusiness Development Center and it is an initiative of the Rabobank foundation and dfcu bank. The two signed an MOU in 2015 to start this iniative.

The Rabobank foundation did the same initiative in Tanzania with the NMB foundation six years ago to assist farmers and we thought that it would really be a good initiative for Uganda. The Rabobank invested in dfcu bank and it is a Dutch agriculture corporative bank.

The money which was injected into ADC by dfcu Bank and Rabobank Foundation in the Netherlands is set to benefit farmers for the next five years. Today, it is the second largest bank in the Netherlands. They said they would like to play an important role in the agricultural sector of Uganda.

What type of farmers do you target?

We look at the value chain where investments are needed. We selected value chains that we think are relevant, such as maize, sugarcane, dairy, oilseeds. The farmers we look for must be working in groups and cooperatives. They have to prove that they are part of an active group or cooperative.

They have to show that they have been active for the last three or four years. We don’t want to have farmers that are forced in a group just because they want to have access to finance. We started our first training in Lira a few weeks ago.

Agriculture is one of the most unpredictable sectors affected by changes in weather, making it a risky venture for banks to advance credit. How do you hope to turn this around?

Dfcu bank is now developing new agricultural products, part of which is agricultural insurance.

So, if you get a loan from dfcu bank, then the bank will advise the farmer to get insurance as well so that when there are problems such as drought, then a farmer can get some of his money back.

But insurance is one of those things that Ugandans haven’t embraced fully.

Even in that sector, it will be about training and educating the farmer about what they should be looking at when looking for insurance.

It is the same as talking to the banks; some farmers fear to negotiate interest rates; they think that they are fixed, yet actually, it’s about negotiating a product. The farmers should be able to ask the difficult questions when negotiating for an insurance product.

Are there some selected parts of the country that you are going to focus on?

There are some areas because of the value chain. We also look at the branches of dfcu bank because they give us office space.

So, our business advisors will be in all those areas where dfcu bank has a branch. Now, the bank has more branches; it means we can be in most parts of the country. As for now, we have started in Hoima, Mbale, Lwengo, Masaka and Lira. So, depending on the success and finances, we will spread out to other parts.

What would you identify as the biggest challenge that farmers face?

Lack of access to finance has got a huge impact on the agricultural sector. This has made it very difficult for farmers to get quality products and this has led to farmers having very low-quality produce.

So, if they can get access to enough funding for their products they can also improve on their yields. And once they are able to increase their yields, even if for one season, they can build their capital and in the next season they can start buying better-quality products.

Farmers also complain about markets, saying even when they have got better yields they have nowhere to sell them. Is that something you would address?

If a farmer would know his market well, he would start planning when to start sowing. But at the moment, farmers don’t care about these things. They start thinking about the market when the product is almost ready.

This is one of the things that lead to low market prices. When farmers know there are not enough tomatoes on the market, like in January, February, and March, because it’s a dry season, then they start targeting that period to sell tomatoes.

So, if you teach them how to do production planning and target different seasons, you will see that many farmers will get better prices. And if you have got a cooperative and you have a storage facility, then you can store your produce and sell when the prices are better.

Why did you choose agriculture and not any other business?

The majority of people in this country earn their living from agriculture. Dfcu also has agriculture as one of its strategic sectors. So, that’s why we have a strong focus on it.

At least 80 percent of the country still depends on agriculture. [Uganda also has] one of Africa’s most growing populations. All these people need to be fed.

On November 29, we will introduce ADC to the whole country so that people are aware that we have started our activities. Those interested can apply and also bring on board other stakeholders in the agriculture sector to partner with us.

SOURCE THE OBSERVER

Over 100 farmer groups set to benefit from 10 billion shilling fund

(From left) The managing director of dfcu Bank Juma Kisaame, ADC’s Anja de Feijter, Ambassador Henk Jan Bakker, state minister for co-operatives Frederick Ngobi, Jimmy Mugerwa and chief executive officer of Rabobank Foundation Pierre Van Hedel cutting the cake during the opening of the agribusiness centre at Kampala Serena Hotel on November 29.

Over 100 farmer groups dubbed farmer-based organisations (FBOs) countrywide that have the potential to contribute to the agricultural value chain are to benefit from the sh10.08b fund ($2.8m) obtained by Agribusiness Development Centre (ADC).

This, according to ADC executive director, Anja de Feijter will improve their operations and ultimately become bankable.

She said the organisations will receive the technical support, training on financial literacy and choice of enterprise.

The development was announced during the official launch of ADC at Kampala Serena Hotel.

The money was injected into the organisation by dfcu Bank and Rabobank Foundation in the Netherlands and the fund is set to benefit farmers for the next five years.

Feijter explained that ADC business advisory team is currently pre-visiting over 100 farmer based organisation’s (FBO’s) countrywide and that since October, 70 FBOs have been selected to receive the training skills in governance, financial management, financial literacy, marketing and risk assessment

With these skills, the farmer based operations will continue to grow their operations in ways that are of benefit to both them and the wider communities,” she noted, adding that ADC which started operations in October this year has skilled 44 farmer leaders from 20 FBOs from Lira, Dokolo, Kole, Alebtong and Oyam with skills in governance.

DFCU’s board chairperson Jimmy Mugerwa commended the efforts being taken by the farmer based organisations to acquire finances through forming groups.

Agriculture is the number one breadwinner for our country and there is a need for collective effort to support it. By facilitating ADC in its operations dfcu and Rabobank are building capacity for the farmers to access much needed financial services, he said.

He added: dfcu already provides tailor-made products for the farmers and with the capacity building delivered through ADC the smallholder farmers will be more eligible for financing from commercial banks.

They will also be better placed to increase productivity and possibly embrace commercial farming which is more profitable at household and national level.

The ambassador of the Kingdom of the Netherlands in Uganda Henk Jan Bakker noted that lack of skills is the major deterrent to work with smallholder farmers, hence the need to train and educate them in vocational training.

Allow me to make a reference to the situation in my home country. Educating and training of farmers has been one of the key elements in the successful development of the agricultural sector in Netherlands. Agricultural education and training has developed close farmers in partnership with the private sector, he stated.

200 farmers educated in agribusiness management

LIRA. About 200 farmers from Lira District have benefited from a two-day agribusiness enterprise management training organized by the Agribusiness Development Centre (ADC).

Speaking at the closure of the training, Ms Anja de Feijter, the executive director ADC, said they are optimistic that the training will adequately empower farmers with financial knowledge, business management and marketing skills which lack in farmers in Northern Uganda.

We needed to provide these farmers under farmer organisations and small medium enterprises in the agricultural sector with financial literacy, business management and marketing skills which will positively impact in their different business enterprises,” Ms Anja said.

She added: “Through our partnership with Rabobank Netherlands and dfcu Bank, we have invested in the process that we believe will change the trend of farming and agribusiness in this part of the country (Northern Uganda).

Beneficiary’s view

Ms Margret Acen, a beneficiary, said she discovered that it was possible to store crop produce beyond one season and sell at better prices as well as seek better markets through uniform bargain.

I previously would sell my crop produce immediately we harvest and before I get to the next planting season, there is no money to buy planting seeds but the lesson today has opened my eyes on the significance of good storage, she said.

She said middlemen always cheated them by dictating for them low prices compared to what they were supposed to get as final returns.

Using a team business adviser, ADC plans to select existing farmer groups and train them, carry out regular follow-ups and make sure they are improving and practising the concepts learnt, said Ms de Feijter. About $1m (Shs3.6b) has been sunk into the programme according to her.

In an interview, Mr Godfrey Mundua, the dfcu Bank head of corporate and institutional banking, said they patterned with ADC and singled Lango region because it has many agricultural activities that are important to support.

Through the resource centre, will be able as a bank to directly support these farmers with business loans and train them different financial management skills. We will also link them with bigger buyers just as we took them to Mt Meru Millers, one of our biggest clients, Mr Mundua said.

After concluding the training, ADC also launched its resource centre in Lira, a centre through which the farmers will directly have training and consultations with ADC expertise on agribusiness.

UDB to inject Shs6b to empower innovators

Boosting Innovations

The Agribusiness Development Centre (ADC) executive director, Anja de Feijter, tipped farmers on the use of modern farming methods such as mechanization to increase production quantities.

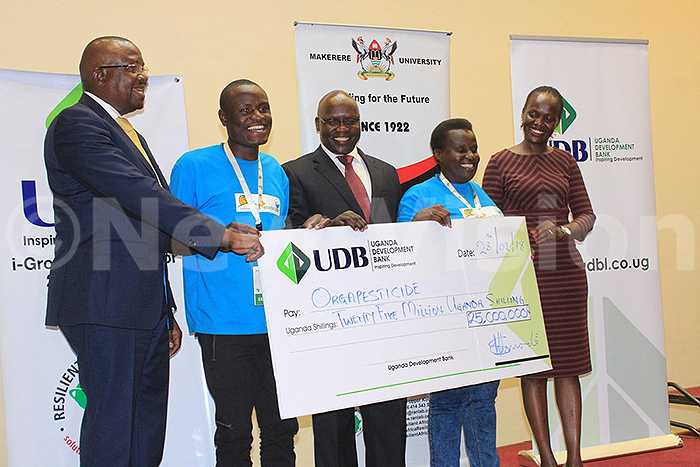

KAMPALA – The Uganda Development Bank (UDB) is to inject sh6b to empower innovators to enhance their skills, acquire more machines as well as market their innovation products.

This, according to Prof. Samuel Sejjaaka, the UDB board chairman, is aimed at creating more jobs and enhancing economic development.

Sejjaaka, during the I-Growth Accelerator awards for 2017/2018 financial year, said the bank will invest sh5b as equity in viable projects, meaning they will partner with innovators until they break even, while the other Shs1b will be venture capital. The event took at Hotel Africana in Kampala.

Prof. Barnabas Nawangwe, the vice-chancellor of Makerere University, noted that there is need for the Government to offer interest-free loans to innovators so that their products can compete on the globe, saying they were laying strategies at the institution.

We at Makerere University have started new strategic plan to transform Makerere into a research-led university,” he stated.

The Prime Minister Ruhakana Rugunda, who was represented by Gabriel Ajedra, the state minister of finance in charge of general duties, noted that innovations in the agriculture are necessary for economic development of Uganda.

He reiterated the Government’s efforts in boosting innovation through the innovation funds, which are channeled through the Ministry of Science, Technology and Innovation.

The Agribusiness Development Centre (ADC) executive director, Anja de Feijter, tipped farmers on the use of modern farming methods such as merchanisation to increase production quantities.

She said farmer trainings of literacy and entrepreneurship skills are necessary for transformation of agriculture. Last year, ADC got a boost of Shs10.8b for training community-based farmer organisation on train farmers in governance, financial management and risk management, among others.

We have trained 75 farmer organisations and we are going to scale up the number of individual farmers in Hoima, Mbale and Kampala,” she stated.